These days, owning a credit card has become more of a necessity than a luxury. After all, it caters to the different needs of individuals – whether they are aimed at consolidating debt, addressing emergencies, or even purchasing everyday and big-ticket items.

Since no person has the exact same set of circumstances, it makes sense that they want different credit cards to suit their needs and their lifestyle. Thankfully, having a Virgin Money Credit Card addresses their particular concern from earning points or getting a transfer balance.

Look no further for individuals who want to get in on the perks provided by the Virgin Money Credit Card. This article highlights the best that this product has to offer and how one could get this card.

- Get To Know The Virgin Money Credit Card

- Features And Benefits That Come With A Virgin Money Credit Card

- Applying For A Virgin Money Credit Card

- Fees And Charges That Come With Owning This Credit Card

- Managing The Virgin Credit Card

Get To Know The Virgin Money Credit Card

There are different types of credit cards offered by Virgin Money for just about anyone. These credit card products fall under categories such as Balance Transfers, Money Transfers, All Round Credit Cards, and Virgin Atlantic Credit Cards.

This range of credit cards is designed to suit the varying needs of different kinds of people. Whether these applicants and cardholders intend to consolidate their debt, get money straight into their account, or get great deals on everyday spending, a Virgin Money Credit Card can cater to any of these needs.

All of the Virgin Money Credit Cards are issued by Clydesdale Bank PLC as they are trading as Virgin Money.

Who This Card iI For

Given that it addressed different types of needs, it can be said that a Virgin Money Credit Card is for everyone. It is even perhaps the perfect credit card product to suit one’s needs since individuals can choose and control how they want to use their Virgin Money Credit Card.

A Balance Transfer Credit Card is ideal for people who want to move all of their debts into one credit card, while a Money Transfer Card is best for individuals who wish to access an account where they can send money straight to it.

On the other hand, an All Round Credit Card is made for individuals who want to make balance transfers and everyday purchases. The Virgin Atlantic Credit Cards are ideal for frequent flyers and travelers as it can help individuals rack up points with every spend.

Features And Benefits That Come With A Virgin Money Credit Card

To help prospective applicants better know what a Virgin Money Credit Card has to offer, this section will focus on one of the credit card products by Virgin Money – the All Round Credit Card.

Best for those who want to get the best of both worlds, the All Round Credit Card stays true to its name by providing cardholders not only access to make everyday purchases more convenient but also to make balance transfers with ease.

On top of this, the All Round Credit Card also gives cardholders low introductory interest rates not just on balance transfers but also on purchases. This lets individuals enjoy 0% interest on purchase and balance transfers for 19 months.

The low rates allow cardholders to keep their expenses and transactions to a manageable level when they are purchasing everyday and big-ticket items, but also when they are paying off their debts. The cherry on top of this is that the All Round Credit Card does not come with annual fees. This means that cardholders can use their savings from this and allocate it towards other expenses.

Other Unique Offerings From The Virgin Money Credit Card

Right off the bat, when an individual gets approved for a Virgin Money credit card such as the All Round Credit Card, they will automatically be a part of the Virgin Money family. This gets cardholders to access special deals and discounts that make their experience worthwhile.

When it comes to traveling, cardholders can enjoy 5% off on Virgin Holidays, Virgin Holidays – Cruises, get discounts on selected car park deals at BCP airport, and up to 10% on Cottages.com.

For one-of-a-kind experiences, this credit card also gives 20% off on over 2,000 experiences days and 30% off on balloon flights. Meanwhile, cardholders who want to safeguard their family’s health and wellness would be given exclusive deals on Virgin Pure WaterBars for their own homes.

Applying For A Virgin Money Credit Card

Before applying for a Virgin Money Credit Card, interested applicants first need to check their eligibility. It only takes five minutes with the credit checker asking individuals for personal details such as their name, date of birth, email address, and place of residence.

Apart from the aforementioned information, the eligibility checker will also require individuals to disclose their employment and income information, including their annual income before tax.

This credit checker will be used to provide prospective cardholders with personalized results while also ensuring that their credit rating would not be affected. This also gives applicants the peace of mind and confidence they need in knowing what their rates would be or if they will qualify for a Virgin Money Credit Card in the first place.

After the initial assessment, individuals who want to pursue the application will be required to complete the entire online application. To be approved and for the result to remain the same, applicants should be able to provide the necessary documents as proof of their income, identity, address, and the like.

Qualifying For A Virgin Money Credit Card

To apply for a Virgin Money Credit Card, applicants should be at least 18 years of age and must be a resident of the United Kingdom.

Applicants must also have a regular income and provide the documents required by the bank. This can include proof of identification, proof of billing address, employment information, bank statements, and other similar files.

The overall application process can take anywhere from three to four business days, depending on whether or not applicants choose to make money or balance transfers. Once approved, cardholders can get a representative credit limit of £1,200 depending on their creditworthiness.

Fees And Charges That Come With Owning This Credit Card

Owning a Virgin Money Credit Card comes with many responsibilities, including making minimum payments when it is due. Making payments on time allows cardholders to continue enjoying the promotional rates and offers initially afforded to them.

As with getting a new credit card, it is vital for cardholders and even applicants to know just how long their introductory rates will last and what the standard interest rates will be once the promotional period ends. Below are some fees that come with the All Round Credit Card.

- Annual Fee – £0

- APR – 0% for balance transfers and purchases for 19 months; representative variable rate of 21.9% after the introductory period (ranges from 21.9% to 23.9% per annum).

- Balance Transfer Handling Fee – 2.90% while on the promotional period; reverts to 5% after the introductory period.

- Money Transfer Handling Fee – 4% while on the promotional period; reverts to 5% after the introductory period.

- Cash Advance Handling Fee – 5%

- Late Payment Charge – £9

- Over Limit Fee – £9

What To Remember

New cardholders of the Virgin Money All Round Credit Card would do well to take advantage of the promotional period. This can help them save money, especially on purchases and balance transfers.

Bear in mind that the interest rates will go back to the aforementioned standard rates once the introductory period ends. Before getting a credit card from Virgin Money, it would be best for prospective cardholders to assess whether they can make repayments in full and on time.

Managing the Virgin Credit Card

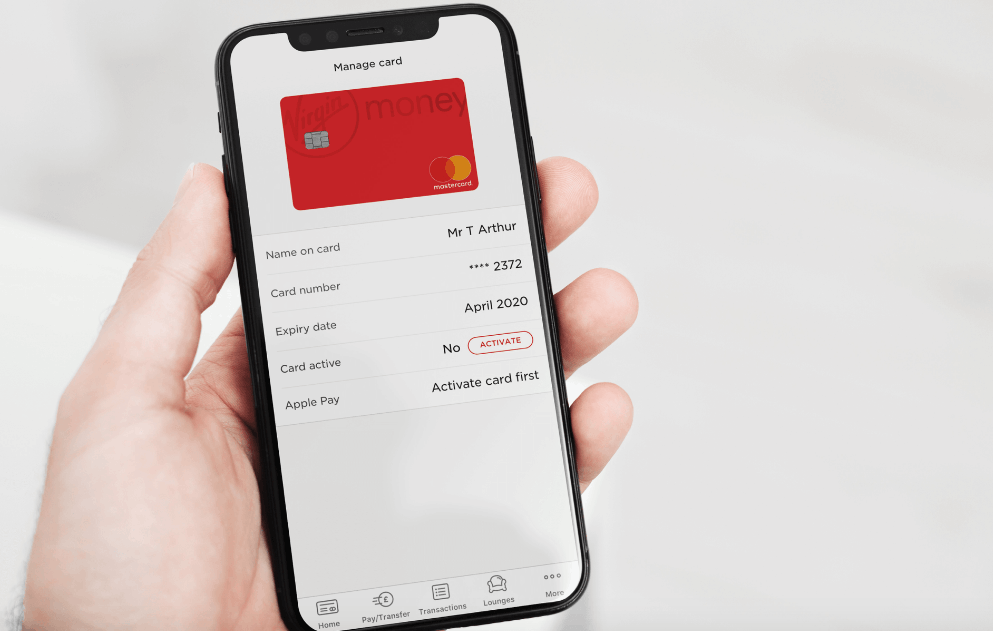

Cardholders will no longer have to go in blindly as they navigate their credit card journey. With the Virgin Money Credit Card mobile application, individuals can stay in control of their finances even while they are on the go.

The app is available for download at Google Play Store and the App Store. This application lets them track their expenditure and transactions, set up payments, and do transfers without leaving home.

It also lets members make direct debits, freeze new cards, order new ones, and change their details.

Bank Address And Contact Information

To get this credit card, users can call 0800 389 2875 for queries about applications. For activation, call 0800 633 5045.

As mentioned, Virgin Money Credit Cards are issued by Clydesdale Bank PLC located at 30 St. Vincent Place, Glasgow, G1 2HL.

The Bottom Line

The Virgin Money Credit Card offers a lot of valuable features for all kinds of consumers. Get in touch with the bank to know more about this offering.

Disclaimer: There are risks involved when applying for and using credit products. Ensure you consult the bank’s terms and conditions page before agreeing to anything.