Having a credit card comes with pros and cons. Understanding its offers helps us make better decisions on our spending habits. We then get a full sense of what we are getting into, and then borrowing becomes more comprehensible.

To be discussed in this post is the Ocean Finance Credit Card. With this detailed guide, you would be up-to-date on this credit card’s interest rates, eligibility requirements, and benefits.

Included in this package are how-to’s and useful tips for using the card.

- The Company – Ocean Finance

- Details Of The Ocean Credit Card

- How To Know If You Are Eligible For An Ocean Finance Credit Card

- Rates And Fees

- The Student Credit Card

- Review Of The Ocean Finance Credit Card

- Bank’s Contact Details

The Company – Ocean Finance

Ocean Finance started out as a loan and mortgage company in 1991. It was acquired by AID in 2006 before it was bought six years later by Think Money Group, the company’s current owner.

In 2008, Ocean Finance launched its TV channel for advertising and promoting loans and mortgages. In 2014, it released its first and only credit card with Capital One – The Ocean Finance Credit Card.

The card was aimed at people who wanted to repair their credit score.

How Ocean Finance Credit Card Helps Improve Credit Scores

Being a responsible borrower helps improve your credit score. To be termed responsible, you should show prompt and regular repayment every month.

You can also achieve this by staying under the limit of money that you are allowed to borrow.

At this point, it is essential to note that while the card may help repair credit scores, showing a bad attitude towards repayment by not being responsible damages your creditworthiness even more.

Details Of The Ocean Credit Card

The credit card allows up to three other cardholders for a single account. This makes it possible to share credit with family and friends keeping an organized sheet.

The card is offered to individuals of different credit histories and financial situations.

People with better chances of paying back are favored, but students can apply as well. The Ocean Finance Credit Card can be used to purchase a vocational course, and it can be used in daily spendings such as groceries and necessities.

What Offer Does The Card Come With?

Unlike some other credit cards, the Ocean Fiance Credit Card does not advertise any rewards on continuous usage. It offers the basic benefit of credit cards: to cover costs that cannot be paid upfront.

The credit card limit is generally between £200 and £1,500. This range depends on your credit history and current situation, which entails timely and well-paid debts. This limit can be increased caused by the same factors (credit history and situation).

You also get free text and email alerts to notify you of how your money is spent. You are also given a Capital One account to help you manage your spending. That’s not all! Your account can be accessed online or through the mobile app.

How To Know If You Are Eligible For An Ocean Finance Credit Card

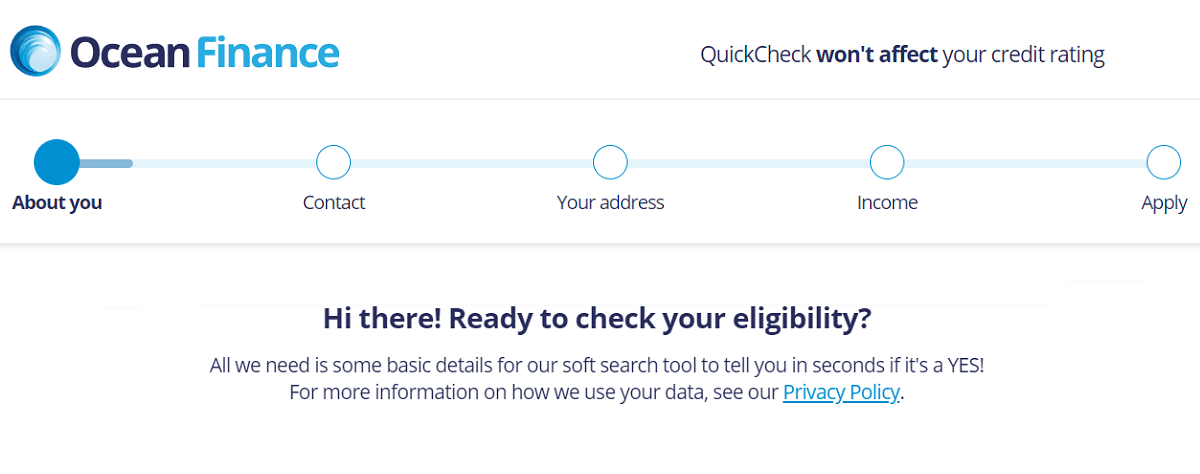

The good news is that you can confirm eligibility with QuickCheck in 60 seconds. QuickCheck is a form where you provide details such as name, address, and income flow to tell you if you would be accepted for the card or not.

The form does not mess with your creditworthiness; as a result, it is secure and can be accessed by you alone. The likeness of being accepted for the Ocean Finance Credit Card is higher if you meet some requirements.

They are, being older than18, having a credit card history, and having registered on the electoral roll.

Applying For A Credit Card

To apply for a credit card, you have to go through the QuickCheck process. After checking your eligibility status, you would be granted pre-approved access if successful, which you would use to submit the online application.

The application process is done through the Ocean Finance website. Here, you would provide more details like your billing information to finish the application process.

It takes between 7 to 10 days to receive your card after being accepted.

Rates And Fees

It is an easily accessible card, but the APR is high for defaulters.

Let us look at the numbers of the Ocean Finance Credit Card.

- Annual Interest Rate: 34.94% (Standard purchases, balance transfers, and cash withdrawals).

- Annual Fee: 0

- Late Payment Charge: £12

- Cash advance fees: 3%

- Overseas transaction fee: 2.75 %

- Using the credit card in foreign countries (outside the UK): 2.75%

Other Features Of The Card

The maximum interest-free days on purchases after getting a card is 56 days. You are also given 26 days to pay a minimum monthly payment of 3% of acquired debt.

You are not charged a transfer fee when you move debts from other credit cards into the Ocean Finance Credit Card.

The Student Credit Card

Since the eligibility requirements for the Ocean Finance Credit Card are based on your income and being above the age of 18, students are automatically put at a disadvantage. For this reason, students are considered and offered student credit cards to help out their various needs.

Students should really think things through before applying for credit cards.

And even though there might be several needs relating to schooling activities that require funds, not having a steady income stream can really affect your creditworthiness at an early stage.

How Different Is The Student Credit Card From The Regular Credit Card?

For the same reasons that put them at a disadvantage, the credit card limit is lesser than regular users. That is because it is hard to detect if they are responsible borrowers as most of them have no prior history.

This is also because their spending habits can be erratic, and spending might not be managed properly at that time.

Capital One keeps all these points in mind when evaluating students, and that is why a special type of low-cost credit card is offered.

Review Of The Ocean Finance Credit Card

Reviews in this section are from the Trustpilot review of the credit card. Good remarks are awarded to the Ocean Finance Credit Card because of the fact that you do not necessarily need to have a good credit history.

Reviews from other users praise the fact that the credit card can be used to increase your creditworthiness and the quick responses from the credit card issuer bank – Capital One. While the Ocean Finance Credit Card is not difficult to obtain, the benefits are not as great as other popular cards.

That is because no benefit is derived when users continue spending with the card for purchases. Also, the APR of 34.9% compared to other cards is pretty high, and defaulters who do not pay on time are subjected to high interest rates.

Canceling Credit Cards

It is also advised to cancel unused cards to help control funds. This also helps so your credit card does not fall in the hands of fraudsters, who can use the card without you knowing.

Canceling the card is possible online and by contacting Capital One. Contacting the bank directly is best, so information is handled properly. You would also need to pay outstanding debt to cancel your credit card.

Bank’s Contact Details

You can contact Capital One at working hours regarding any queries you have regarding your Ocean Finance Credit Card at working hours. Working hours are; from Monday to Fridays, between 7am – 9pm; Saturdays: 8am – 5pm; and Sundays: 8am – 5pm.

For general accounts for users residing in the UK, you can reach the bank by dialing 0344 481 2812. If you call outside the UK for general account queries and report a lost or stolen card, the number to call is +44 115 993 8002.

On the other hand, for reporting a lost or stolen card in the UK, dial 0800 952 5267.

Other Lines To Resolve Queries

Other queries can involve you struggling with payments. If you have such a problem and need help, try contacting the bank through 0800 952 4966. To report a fraudulent activity on your account not initiated by you, there are two lines you can call in relation to the type of activity.

For account fraud, dial – 0800 952 5267, while for application fraud, dial – 0800 052 1495. For more information about contacting the bank for various queries, check out the contact us page.

Note: There are risks involved when applying for and using credit; consult the bank’s terms and conditions page for more information.

Conclusion

The Ocean Finance Credit Card has its fair share of pros and cons. Regardless, it serves the important function of paying for items according to the limit given. And if used correctly by being a responsible borrower, it is a pretty solid credit card.