If you are looking for a new credit card, CB Bank should definitely be up there on your list of considerations. You will be able to choose from a variety of options in order to find one that suits your needs and wants.

In this article, we will be discussing everything that there is to know about the CB MNA Visa Credit Card. This includes the rates and fees associated with the card, how you can apply and a number of privileges you will receive in turn.

- CB MNA Visa Credit Card

- Privileges of This Card

- Savings You Will Receive

- Efficiency and Control

- Rates and Fees

- Requirements to Qualify

- Your Creditworthiness

- About CB Bank

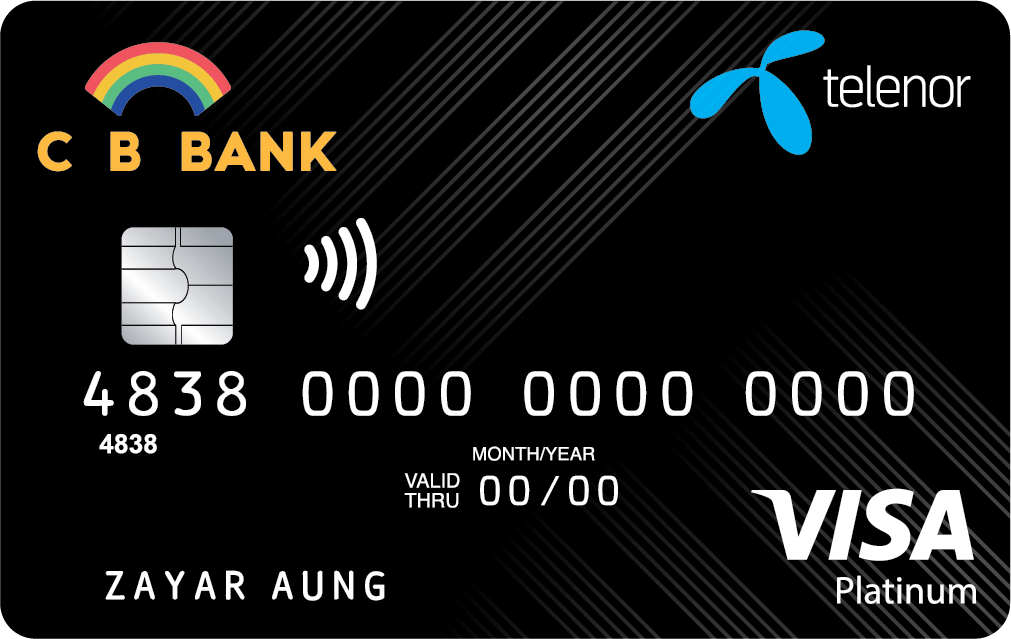

CB MNA Visa Credit Card

The CB MNA Visa credit card is a great option for just about anybody. As we will discuss later on, the card includes a number of great privileges and benefits.

On top of this, the monthly fees and costs are very reasonable, making the card well worth the effort. However, it is important to note that not everybody will qualify for the card.

It is incredibly easy to sign up for this card. You can find the contact details of the bank on the official CB Bank website.

In order to apply, you will have to send in an application and wait for it to be approved. If your application is accepted, you will receive your credit card within a couple of days.

Sign Up for the Credit Card Using the App

You could also use the CB Bank app in order to apply for an account. This app is a great idea if you are looking at taking out the credit card, as it includes a number of services.

For example, you will be able to manage your card on this app by making any necessary payments.

More so, you can set reminders on your phone in order to ensure that you do not make any late installments.

Privileges of This Card

As we have already mentioned, you will experience a number of privileges after opening an account with CB Bank.

For starters, the bank offers a 15% air ticket discount for CB MNA Platinum credit card holders. On the other hand, if you own a Gold card, you will have a 12% discount.

Credit card holders also earn a total of 3 points for every 1,000 MMK spent with the Platinum option and 2 points with the Gold card.

Platinum users are entitled to 3 times 3 months 0% IPP per annum.

Earn Points

After opening an account, users can start collecting points in order to access ever more rewards and benefits.

At any point, the card holder will have the opportunity to redeem these points by either claiming cash back or through various discounts.

A list of these rewards available can be viewed on the official website.

Savings You Will Receive

The amount that you save every month will depend on the type of card that you have.

If you are a Gold card owner, you will receive 3,000 CB reward points after you make 5 Lakhs or more in purchases within 90 days of opening your account.

On the other hand, if you have a Platinum card, you will receive 5,000 CB points. You can also apply for a special installment plan of 1% per month.

It is important to note that CB Bank offers various pop up promotion offers every month. To get the most out of your account, keep an eye out for these specials.

The Different Card Options

You also have the opportunity to enable contactless payment with any of the cards.

There are a few differences between the Gold and Platinum cards. As we have already discussed, you will receive more points every month if you take out the Platinum card.

With that being said, you will have to pay more in order to take out this type of account. For more information about the different cards, be sure to visit the official CB Bank website.

Efficiency and Control

One of the biggest advantages of taking out an account with CB Bank is the fact that the process is so easy.

On top of this, you will be able to make easy repayments using the official banking app. After making any payment with your card, you can check your account balance and the transaction details.

CB Bank is known for its high convenience and security. You will be able to freeze your account at any time, creating a worry-free experience.

The bank offers cash advances at ATMs with Visa logos in Myanmar and globally.

Repayment Options

Your minimum repayment amount will be 40,000 MMK or 10% of your outstanding amount.

You will have various repayment options for any outstanding balances.

For more information regarding repayments, be sure to visit the website.

Rates and Fees

As we have already mentioned, you will have to pay different rates and fees according to the type of card that you have taken out. With the Gold package, the card issuing fee is 15,000 MMK.

On the other hand, the Platinum package has an issuing fee of 25,000 MMK. You will also have to pay an annual fee of 30,000 MMK and 60,000 MMK respectively.

Users will be charged a card renewal fee of 10,000 MMK. This fee is the same for every type of card.

If you make a purchase with your card, you will pay 20% interest p.a. The credit usage fee lies at 4.5% p.a., while the cash advance fee is 19% p.a.

Card Charges

It is important to note that these rates and fees apply to every card owner. More so, the first year offers waiver fees.

However, after your account has been up and running for more than a year, the fees will only waiver if you spend 1,000,000 MMK p.a. or more.

Requirements to Qualify

As we have already mentioned, not everybody will qualify for the different cards offered by CB Bank.

For starters, only people over the age of 21 should apply for the card. More so, every applicant should have a copy of their NRC or passport to send in.

The bank will need your household registration in order to approve your application.

As with any credit card, your creditworthiness plays a big role in determining whether you qualify for a card. In short, your creditworthiness is used to express the extent to which you qualify for credit.

Additional Requirements

This characteristic is determined by how much money you earn every month. For example, if you have a high salary, your creditworthiness will also be high.

If you own a business, you will need to send in a business license. On top of this, the bank will require bank statements from the previous 3 months in order to ensure that you are a responsible spender.

Finally, the bank will require a testimony of any other legal income services.

Your Creditworthiness

We have already discussed just how important creditworthiness is when it comes to applying for a new credit card. The financial side of this can be determined via your credit score.

There are multiple online services and tests that you can use in order to find out what your credit score is. However, it is important to note that you will need to pay a small fee.

Your financial history also plays a massive role when it comes to whether or not your application will be approved.

If you have a history of making late payments, your chances of receiving the card will be low.

Applying for the Card

On the other hand, if you do not have any financial delinquencies and earn a reliable and steady income, you should have nothing to worry about.

There are numerous ways in which you can go about applying for the CB Bank MNA Visa credit card. If you visit their official website, you will notice an ‘Apply Here’ button in the bottom corner.

After clicking this, you will simply need to follow the on-screen prompts. The banking app can also be used to open a new account.

About CB Bank

CB Bank is the largest and most successful bank in Myanmar. To be more specific, they have over 244 branches across the country.

If you have any additional questions regarding the CB MNA Visa credit card, be sure to visit their official website. Here, you will find a detailed description of the card and the features that it includes.

On top of this, the bank offers an online form that can be used to post any complaints or queries. It also has a FAQs section, meaning that you may find additional help here.

It is important to note that even though the bank is based in Myanmar, the credit card can be used globally.

Contact the Bank

If you need to contact the bank for whatever reason, you can call them on the following number: 01-2317770. You can also use the following email address: [email protected]

Their head office is located at No. (46), Union Financial Center (Tower A & B), Corner of Mahar Bandoola Road & Thein Phyu Road, Botahtaung Township, Yangon, 11161 Myanmar.

However, it is important to note that the banking app does have a messaging feature in order to make this process easier.

Summary

CB Bank offers a number of great credit card options. The CB MNA Visa credit card comes with a number of privileges, benefits and features, making it a great choice.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.