The pandemic has truly impacted the lives of every person in every corner of the world. People struggled to provide for their families due to restrictions and lockdowns that prompted businesses to close and companies to lay off employees.

To address the situation, governments rushed to formulate ideas on how to help business owners and employees that were affected by the pandemic. The Canadian government came up with the Canada Emergency Response Benefit (CERB) as its solution to this problem.

To know more about CERB, who are eligible to receive it, and how to apply for it, continue reading below.

- The Impact of the Pandemic on Canada’s Labor Market

- About the Canada Emergency Response Benefit

- Eligibility for the Canada Emergency Response Benefit

- How to Apply for the CERB

- When to Expect the CERB and What to Do Next

The Impact of the Pandemic on Canada’s Labor Market

To illustrate the impact of the pandemic on the Canadian workforce, let me emphasize that the country has lost more jobs in March and April 2020 than in the past three recessions that it suffered combined. During those two months, 3 million people out of Canada’s 19 million labor force lost their jobs due to the pandemic.

While almost 2.4 million jobs were later added between May and September 2020, the recovery rate has slowed down due to the resurgence of further waves of cases. As of October 2020, employment levels in the country were just 635,000 less than the peak level in February.

This recovery may be attributed to government support measures such as the CERB. As a result, Canada’s federal debt-to-GDP ratio has increased from 31% to around 50%.

Similar to other OECD nations, Canada has been able to sustain public financing by maintaining low interest rates and lifting pandemic-related measures quickly.

Employment Changes by Dimensions

The onset of the global pandemic had an uneven effect on the country’s labor market, particularly in terms of age, wage, sector/industry, immigration status, gender, and geography. Employment loss was most evident among those ages 15 to 24 with 34.7%, followed by ages 55 to 64 with 13.7%.

Low-income jobs were particularly affected, with 26.1% losing their work. It wasn’t surprising that the sector that was most affected was accommodation and food services since most establishments were closed down due to the threat of infection.

Women saw a slightly higher percentage of job loss than men at 16.7% and 14.1% respectively, while those whose highest educational attainments were high school and post-secondary diploma had the highest number of job losses at 16.8% and 13.9%, respectively.

About the Canada Emergency Response Benefit

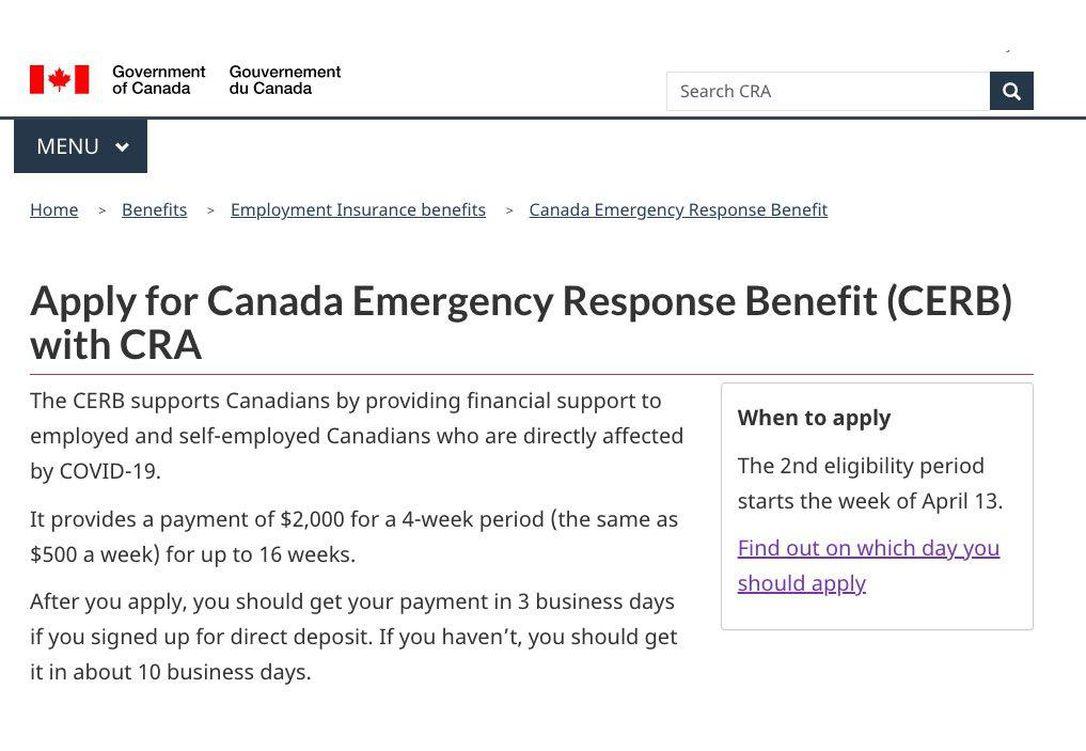

The Canada Emergency Response Benefit or CERB is a benefit provided by the government of Canada to provide temporary income support to those who lost jobs because of the pandemic.

The Employment and Social Development Canada (ESDC) and the Canada Revenue Agency (CRA) jointly administer the benefit.

The CERB provides $500 CAD per week, or $2,000 CAD per month, to eligible residents for a maximum period of 28 weeks.

Within a week of the program’s launch in April 2020, almost 3.5 million applications were received by the ESDC and the CRA through their online portals. Applications more than doubled only a couple of weeks later to 7.12 million by April 24th.

Extension of CERB Beneficiaries

On April 15, 2020, the Canadian government decided to extend the CERB to seasonal workers, those who had zeroed out their Employment Insurance (EI) regular or sickness benefits, and workers who returned to work but still earn less than $1,000 CAD per month due to reduced hours or lower demand.

Eligibility for the Canada Emergency Response Benefit

Now that you’ve learned about what the benefit is about, you might be curious about who is qualified to receive this benefit. Under the CERB program, you must be a resident in Canada, 15 years old or older, and must have lost your job or earn less than $1,000 CAD of income in a span of four weeks.

As mentioned above, it was extended to include workers who have exhausted their EI benefits, people who are sick or quarantined, and parents who are forced to stay home without pay to care for their children who have been infected by the virus.

The eligibility covers full-time employees, contract workers, and those who are self-employed.

Another qualification is that you must have received at least $5,000 CAD in income as an employee, self-employed worker, or from maternity or parental leave benefits for 2019 or in the 12-month period prior to your submission of the application.

Ineligible for the CERB

The government emphasized that job loss should be related to the pandemic and should have occurred on or beyond March 15, 2020. This also includes workers who received at least one week of EI benefits after December 29, 2019.

This means that students who failed to get a summer job, seasonal workers who did not receive EI benefits after the aforementioned date, and workers who were already unemployed and without EI benefits are disqualified from CERB.

Receiving non-employment income, such as emergency income support from your province, social assistance, workers’ compensation, or pension income, does not disqualify you from the CERB. However, your province may reduce the income support you may receive if you are already receiving the CERB.

How to Apply for the CERB

In order to the benefit, you must submit your application either through your CRA MyAccount secure portal, through your secure My Service Canada Account, or by calling a designated toll-free number equipped with an automated application process.

You will be asked to provide several details, including personal contact information and social insurance number, and will undergo confirmation of the eligibility requirements.

If you want to apply using the CRA portal, you need to click ‘COVID-19: Canada Emergency Response Benefit’ in the alert banner at the top of the page and then select the period you want to apply for. You will be then asked to declare your qualification for the benefit and confirm that the CRA has the right payment information for you.

Those who cannot access the online portals may call the automated phone service at 1-800-959-2019 and follow the instructions given by the automated prompts. You will be asked for your Social Insurance Number (SIN), postal code confirmation, and period you are applying for, before finally declaring your eligibility for the benefit.

How to Follow Up on Your Application

If you have any questions about your application, you can always follow up with the CRA or Service Canada.

If you submitted via your CRA MyAccount and want to know the status of your CERB payment or update your address or direct deposit information, you may contact the CRA at 1-800-959-8281. Meanwhile, you may call 1-833-966-2099 if you have questions about reapplying for the CERB.

On the other hand, if you used Service Canada to file your CERB application you can call 1-800-206-7218 to ask about the status of your CERB payment, to update your address or direct deposit information, if you are missing your access code for EI reports, or to get help with your EI reports.

When to Expect the CERB and What to Do Next

Upon successful application, benefits should be deposited to your account within three days of your application for direct deposits, while checks will be delivered within 10 days following your submission of the application.

If you are receiving CERB via Service Canada, you are expected to submit your internet report every 2 weeks if your current situation persists and you want to continue receiving CERB.

You will need your access code, a four-digit number giving to you alongside your benefit statement, and your SIN to submit reports.

If you are getting your CERB via the CRA, you need to re-apply every four weeks to continue receiving CERB for a maximum of seven times or 28 weeks in total.

When to Return Your CERB Payment

There are several instances where you may want to return or are required to repay the CERB you were issued. This will be applicable if you return to employment earlier than expected or if your employer gives you retroactive pay.

You may also return your CERB payment if you filed an application but later realize that you do not have eligibility. You may be required to repay the CERB if you receive a payment from both Service Canada and the CRA for the same period.

Summary

The effects of the pandemic have been tremendous on employees and self-employed workers in Canada. It’s unimaginable to try to survive amidst the threat of infection without any money to spend on you and your family’s everyday needs.

It’s one thing to be sick but it’s another to be sick or be threatened by sickness while having nothing to eat. Thankfully, government initiatives such as the CERB are a welcome relief to this unexpected situation.