Zelf allows you to bank using your preferred messenger app. Instead of using a third-party banking app, you can perform all of your banking tasks through your messenger app, such as Facebook Messenger or iMessage.

Next, we’ll go through the necessary steps to get the Zelf card. If you’re looking to change the way you bank, then you’ve come to the right place.

- What Is Zelf?

- What Can You Do with a Zelf Account?

- The Zelf Card

- Topping Up Your Zelf Card

- The Limits to Zelf

- Receiving Money with Zelf

- Fees That Zelf Charges

- Interactive Menus in WhatsApp

- How to Join Zelf

- Verifying Your Zelf Account

What Is Zelf?

Zelf is a banking service that allows you to perform all of your funds management through your preferred messenger app, like iMessage or WhatsApp.

The banking works through ‘commands’ that you send to Zelf, and the company responds to help you carry out your tasks.

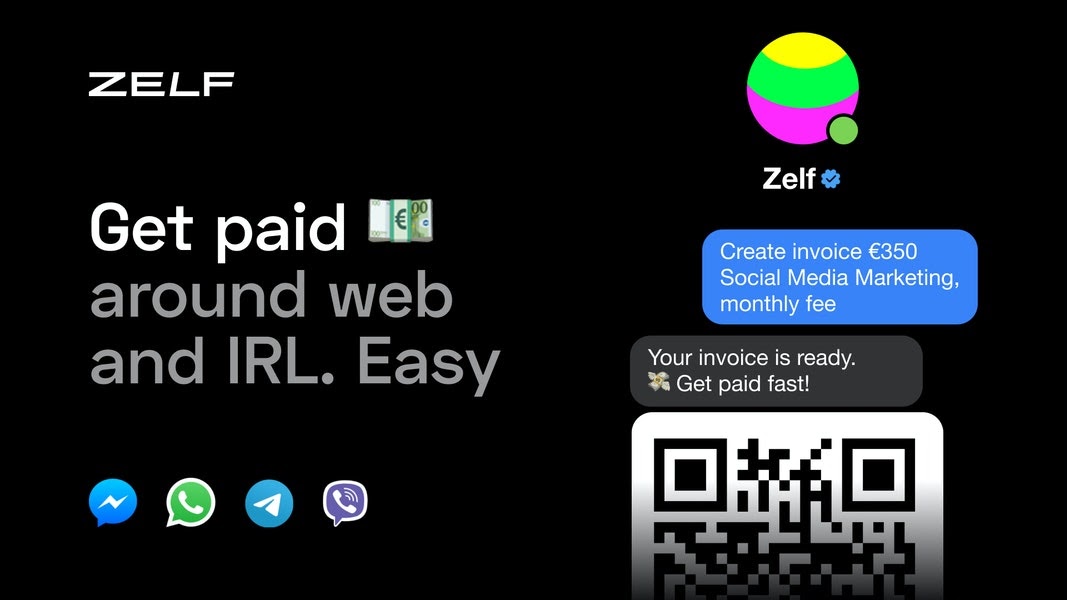

Zelf works via a bot. You send the bot commands through your messenger app, such as ‘Create invoice $350 Social Media Marketing, monthly fee’.

The bot will then perform the command and will respond with a message confirming that the action has been carried out.

It’s That Simple

That is all there is to it — no complicated banking app, no additional fees, and no need to set foot in a physical bank.

Your messaging app will become your banking platform, and managing your money is as easy as typing a message.

What Can You Do with a Zelf Account?

When you sign up with Zelf, you will be granted access to all of the basic banking operations in a way that is extremely simple and quick.

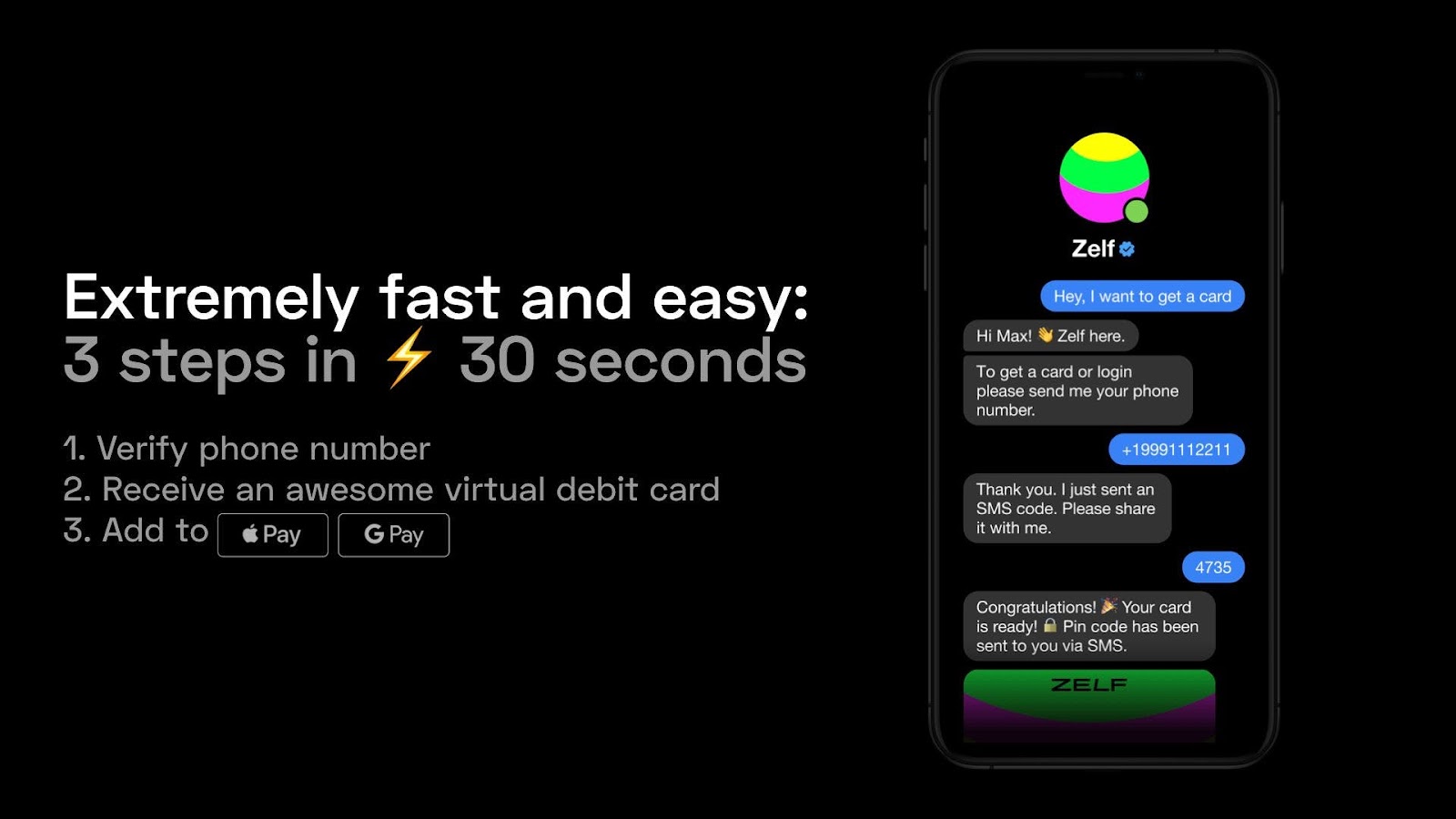

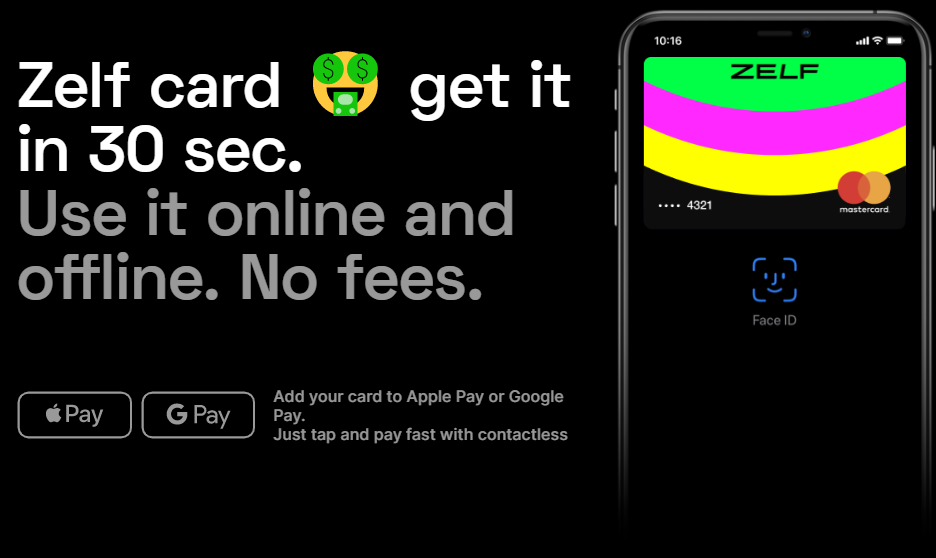

You will be able to pre-order your Zelf card in 30 seconds, and once you have received it, you can add it to your Apple or Google Pay.

For now, the cards are only available in Spain and France, but the company has plans to expand their global reach.

Once you have received your cards, you will be able to check your balance, send and receive money, create invoices and reports, and more.

Loans & Savings Accounts

For now, Zelf does not offer loans or savings accounts through their services, but the company also has plans to add these features at a later date.

If you were looking for those features specifically, you may want to bank elsewhere for now.

The Zelf Card

After you have verified your phone number and your card is ready, the Zelf bot will send you a notification through your preferred messenger app telling you that your card is ready.

At the moment, pre-orders are available globally, but the cards are only available in Spain and France.

You can also stay updated with all of the latest news from Zelf by following their various social media platforms, like Twitter, Instagram, TikTok, Medium.

They even have a Discord server that you can join.

Adding Google and Apple Pay

The great thing about the virtual Zelf card is that you do not need to give your address.

The card will arrive in your messenger as a virtual card that you can add to Apple and Google Pay.

You’ll be notified when the card is ready.

Topping Up Your Zelf Card

You are able to top up your Zelf card in the Top Up menu of the bot.

To start, you can enter the My Zelf menu, tap on Top Up, and select From Another Card, which will transfer funds from one card to your Zelf card.

Alternatively, you can enter your credit card details, including your card number, expiry date, and CVV or CVV2 code in a secured browser window.

Enter the amount that you would like to top up. Then, click Top Up and follow the prompts, and you’ll be done.

Topping Up Via IBAN

You can also top up your Zelf account using IBAN. Simply navigate to the My Zelf Menu, tap on the Top Up button, and select Reveal My IBAN.

Then, you will need to copy your IBAN and make a bank transfer from another account into your Zelf.

The Limits to Zelf

While Zelf might sound like the perfect convenient solution to digital banking, it does have its limits, especially when it comes to verified and unverified cards.

You will be considered unverified if you did not provide Zelf with the necessary legal documents.

For unverified users, the limits are as follows: €150 Max Wallet Load Limit, €150 per month Refund Payout Limit, €50 Online Purchase Limit, and a €50 One-Time Top Up limit.

Those are rather strict restrictions, so we recommend getting verified ASAP.

Limits for Verified Users

The limitations for verified Zelf users are much more lenient, and are as follows.

There is a €1500 Max Wallet Load Limit, €250 per month Refund Payout Limit, €500 Online Purchase Limit, and a €500 One-Time Top Up Limit.

Receiving Money with Zelf

Receiving money with Zelf is easy, as well. You can share your Zelf card details by going to the My Zelf menu, tapping on the Card menu, and selecting the Reveal My Card option.

You can also send your IBAN to the person that you will be receiving money from.

However, we must note that you will only be permitted to send and receive money through Zelf after you have verified your account.

This involves providing the company with all of the necessary legal documentation.

Withdrawing Cash

If you have verified your Zelf account and received your virtual Zelf card, you will be able to withdraw cash through contactless ATMs.

This helps simplify the withdrawal process, since you won’t even have to insert your card into the machine.

Fees That Zelf Charges

One of the best things about banking with Zelf is that they do not charge fees for transfers.

The only fees that they charge is for Top Ups from other banking cards. What’s more, top ups from another IBAN are always free.

The first Top Up that you make to your Zelf account will be free. All Top Ups after that will cost approximately 1% of the amount that you are transferring, but it will never cost less than €1.

Premium account holders will receive 3 free Top Ups, while Pro users receive 10.

Sign Up Cost

Signing up for Zelf is completely free, and it is especially useful for those who are looking to boost their savings accounts or expand the limits.

They will have paid plans coming soon that will offer much more functionality.

Interactive Menus in WhatsApp

Until now, many people who were using Zelf in WhatsApp had to text their responses to the bot, but Zelf recently updated their service.

It now includes buttons in WhatsApp that make banking through the messenger app much easier.

The buttons that have been implemented into WhatsApp were designed specifically for customer care automation and are limited to only three at a time.

However, Zelf was able to repurpose them to build the first full-scale financial service business in WhatsApp.

Simplified User Experience

All of the main actions that the Zelf bot could perform have been transformed into buttons for your convenience.

You can reveal your Zelf card, view your balance, top up your card, order a statement, and much more with just the touch of a button.

How to Join Zelf

Joining Zelf is an extremely simple process and takes just 30 seconds. The process is easy because there are no third-party applications involved.

To start, you will want to navigate to the Join Menu on Zelf’s website.

Then, you will want to scan the QR code. After you have done that, you will need to select the messenger application that you want to use Zelf out of.

And once you have done that and provided some of your basic information, you will be able to start banking with Zelf.

Earning with Zelf

Zelf rewards you when you invite your friends to use the app.

You can receive a referral link by pressing the Invite button in the chat of your messenger.

Then, once you have sent it to your friends and they have joined, the both of you will earn a bonus.

Verifying Your Zelf Account

When creating Zelf, the developers wanted to make the signup process as pain-free and smooth as possible.

Therefore, opening your account does not require you to provide any legal documentation.

However, when you want to withdraw, spend money, or receive money from another user.

And of these transactions reach a value of over €150 in 30 days, you will be required to provide your ID and proof of address.

Easy Access

Otherwise, you will not be able to perform those tasks.

Don’t worry. Once you have provided those documents, you will have access to the aforementioned features within minutes.

You do not have to deal with more ridiculous waiting times.

Summary

Zelf is going to revolutionize the way we do online banking. Why not join and become part of the future?

We hope that you found this guide useful and that we’ve helped you learn more about Zelf.